Following our research in Paris, DXOMARK conducted its Insights study about smartphone portrait photography in Shanghai, China. The goal of the study remains to understand user preferences, expectations and pain points with portraits captured in everyday scenarios. At DXOMARK, we observe and analyze any technologies and advancements that are meaningful in improving for the user experience. When it comes to smartphone photography, we naturally turned our attention and research to the HDR format, a feature that is being integrated by all manufacturers into various products, with a particular focus on portrait, one of the most common but challenging use cases.

In this article, our findings will show the areas of image quality that help identify the preferences of Chinese consumers.

FOUR KEY TAKEAWAYS

- Pictures taken with Huawei and Vivo flagships are generally preferred by the panel in most lighting conditions, surpassing even the photographer’s rendering.

- HDR imaging is a game changer, but the formats are not perfected, and brands are still exploring different strategies.

- A brighter face rendering is generally preferred by Chinese consumers, but only to a point (the skin tone should not look too oily or too bright).

- Flagship devices still face issues when it comes to specific use cases.

Methodology in brief

This DXOMARK Insights study on smartphone HDR portrait photography was conducted to evaluate the perceived quality of images captured in HDR formats, rather than their playback qualities on proprietary smartphone screens. We applied the same methodology used in our Insights Portrait study in Paris, with a focus on the visualization of HDR images under standardized conditions.

The study involved seven of the latest flagship devices popular in China: Apple iPhone 15 Pro Max, HONOR Magic6 Pro, Huawei Pura 70 Ultra, OPPO Find X7 Ultra, Samsung Galaxy S24 Ultra, Vivo X100 Pro, and Xiaomi 14 Ultra. A full-frame mirrorless professional camera was also included for comparison, with images edited by a professional photographer using an HDR pipeline in Photoshop.

A group of 80 consumers, who also served as models in the photos, and 10 local professional photographers participated in the survey. The aim was to capture the general public’s diversity in age, gender, and skin tone.

See below for more details on how we conducted this survey.

A guide to our China study

HDR stands for High Dynamic Range. It describes a scene with a high ratio between the brightest and darkest parts of a scene.

The term “HDR” can be used in different contexts:

- An HDR scene is a “real world” setting with a high ratio between its brightest and darkest parts. It is the difference in the amount of light between bright and dark areas.

- Image capture HDR technologies allow smartphone cameras to create images that retain details in both shadows and highlights, which might otherwise be lost, partly because smartphones have smaller sensors with less Dynamic Range than a Full-frame professional camera to capture the whole dynamic of an HDR scene. This is achieved by combining multiple shots taken at different exposures into a single image, resulting in better contrast and color accuracy. This technology is especially useful in scenes with high contrast, such as landscapes or backlit portraits.

- This captured image is then stored in a file whose type, format and bit-depth define how much the dynamic of the scene captured will be compressed in the file: for instance, dynamic range will be more compressed in 8-bit .jpeg files (which is the common SDR image format) than in a 10-bit .heif file. When referring to HDR formats, we usually mean a file of 10 bits or more, or an 8-bit jpeg file complemented with metadata called a “gainmap” that describes how to display an image on an HDR display in terms of local brightness.

- HDR displays increase brightness to levels of 1,000 nits or more from the 200 to 300 nits in Standard Dynamic Range. This improvement allows images to be displayed with higher overall brightness, dynamic and therefore improved contrast, but it requires specific file formats or image metadata mentioned above to optimize image rendering on the displays.

The third and fourth aspects imply key differences between the Shanghai and Paris Insights, with the study in China placing more emphasis on the HDR experience in flagship devices, especially by using images in their HDR formats. Some are “in-house” manufacturer-specific HDR formats, others are more publicly available. As a new and fast-developing technology, not all HDR formats can yet be visualized outside the OEM’s ecosystem, so when images are shared (through social media or messaging apps), they are often converted or viewed as SDR images (as jpeg).

The primary objective of this DXOMARK Insights study on smartphone HDR portrait photography was to assess the perceived quality of HDR images captured on smartphones, focusing on their HDR formats rather than the playback quality on proprietary smartphone screens. Consequently, all participants viewed the HDR pictures under standardized conditions (ISO-22028-5) with compatible HDR screens. In addition to being displayed according to each manufacturer’s HDR settings, the pictures were also shown at smartphone-size dimensions.

In addition, due to the technical constraints in displaying HDR content on the web, please note that the photos used in this article are for illustration only. The images in this article are either an SDR version for illustration or have a linear tone mapping applied to them to approximate the appearance of HDR on devices that have limited dynamic range in terms of brightness, which will be mentioned when that is the case. This means that the overall brightness difference between images is more or less preserved compared to their original HDR versions.

The shooting plan was designed to feature the common use cases of Chinese consumers, such as portraits taken in restaurants or against the backdrop of the Shanghai skyline. A total of 400 scenes, featuring a combination of staged settings and 80 models, were photographed under various setups and lighting conditions.

The seven latest flagship smartphones popular in China were used (with public firmware versions available in China when we took images in Shanghai at the end of May 2024) as well as a full-frame mirrorless camera for comparison; the camera’s renderings were edited by a professional photographer using the HDR pipeline in Photoshop.

The models were asked to provide feedback on the photos of themselves. The panel consisted of 80 models and 10 professional Chinese photographers. The survey was divided into two parts:

- Blind pairwise comparison: Participants are asked to choose between two photos of the same scene taken with different cameras. They take part in successive side-by-side comparisons between 2 of the 8 renderings of one scene until they achieve a consistent JOD (Just Objectionable Difference) scale across all 8 images (from 7 smartphones + 1 professional camera).

- Photo series rejection: Participants are shown multiple photos of the same scene and asked to identify which ones they dislike or would not post on their social media.

This two-step survey allows us to collect the following information for each scene:

- the overall rejection rate for all respondents

- the rejection rate for the group being studied

- the JOD scale

A Satisfaction Index is then calculated for each picture, allowing us to determine user preferences and more.

To delve deeper, we included a questionnaire asking our panelists to specify why they might reject a particular picture.

To learn more about the Satisfaction Index, read Smartphone portrait photography: How do we measure user preference?

We gathered 80 consumers, who also served as the models in the photos, and 10 local professional photographers for the survey. The goal was to reflect the general public’s diversity in age, gender, and skin tone. Using scientific studies on skin-tone distribution in Shanghai11A review of the evidence for intrinsic ethnic differences as important determinants of skin aging and carcinogenesis: a hope for all ethnicities – Stephanie Ying Chan and measuring the skin-tone reflectance of our models, we defined six distinct skin-tone groups and built our panel.

The satisfaction ranking in China

How did the most popular devices in China perform? Let’s take a closer look at the results.

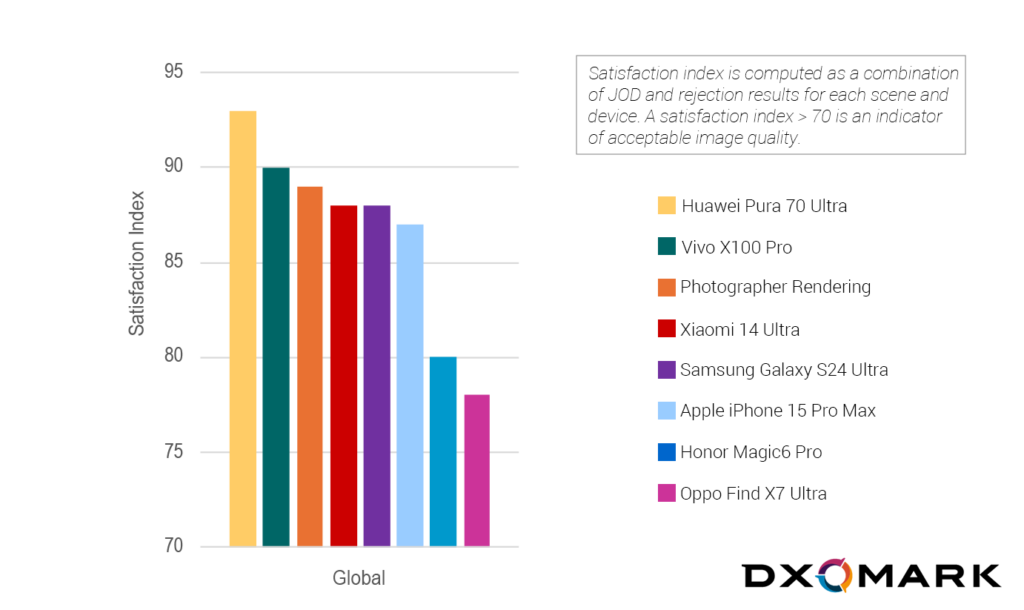

DXOMARK experts developed the Satisfaction Index, a metric that quantifies user preferences when viewing an image and measures the level of satisfaction of respondents. It takes into account several factors and is scored on a scale of 0 to 100, with 0 indicating that the image was rejected by more than 50% of respondents and 100 indicating no rejection at all.

The overall mean Satisfaction Index for all the portrait pictures reviewed in Shanghai is a high 87.

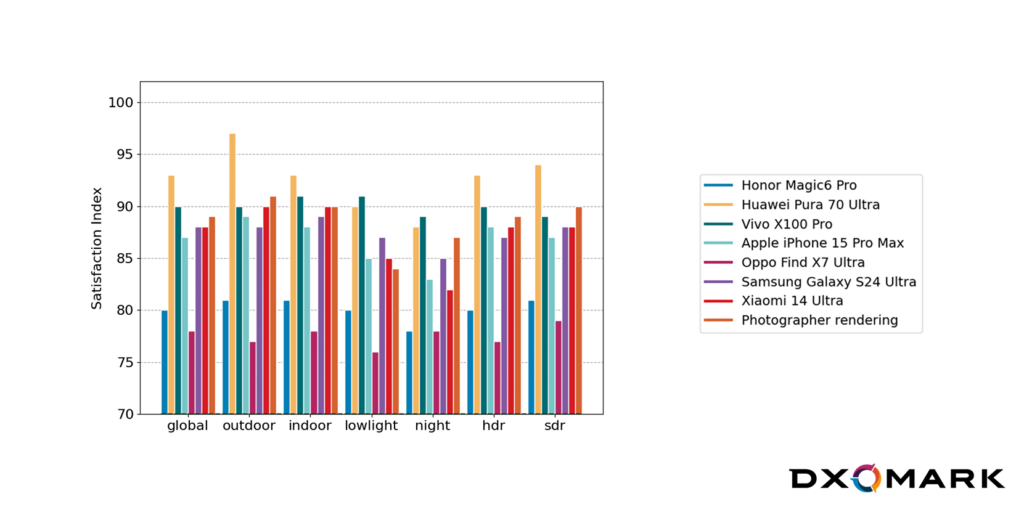

The pictures taken with the flagship devices are generally well-received by Chinese users. Huawei Pura 70 Ultra and Vivo X100 Pro are solid performers in all conditions, with an overall satisfaction index of 93 and 90, respectively. They are even preferred over the photographers’ renderings.

Our survey found that an astounding 76% of the respondents preferred images from the Huawei device, ranking it No. 1 on average for all 400 scenes, followed by Vivo at 11%.

In outdoor conditions, the Huawei Pura 70 Ultra is the preferred choice by a significant margin, achieving a Satisfaction Index of 98, 15 points more than its closest competitor. The Huawei Pura 70 Ultra and the Vivo X100 Pro also perform well in low light and night conditions, taking the leading positions as the most-favored devices, with the Samsung Galaxy S24 Ultra also ranking highly.

Overall, the level of satisfaction remains lower in challenging conditions such as low light and night-time scenes even as manufacturers continue to promote image-quality improvements in those environments.

Participants are not completely satisfied with Honor Magic6 Pro’s and Oppo Find X7 Ultra’s HDR renderings: More than 20% of images achieve a Satisfaction Index below 70.

The game changer in HDR strategy: Where to brighten the image

The Chinese study confirms that every OEM has a unique approach to leveraging the extra luminance provided by HDR screens. Specifically, not all OEMs use the HDR display headroom, or the available dynamic range, in the same way.

What do we mean by “headroom”? For example, SDR displays typically show images within a brightness range of about 200 to 300 nits, with highlights reaching the display’s maximum luminosity. In contrast, HDR displays can exceed 1,000 nits in brightness. Initial industry-standard discussions would suggest setting pure white at around 200 nits and reserve the remaining luminosity (200 to 1,000 nits) for the highlights. This reserved brightness range is referred to as headroom.

Currently, manufacturers employ two main strategies:

- Render the majority of the image content within the SDR range (200 to 300 nits) while using the headroom only for scene highlights. This approach enhances overall contrast but results in lower subject brightness.

- Use the headroom to enhance the face or subject brightness. This approach allocates less of the luminosity range to highlights, resulting in slightly reduced contrast but increased brightness for faces and subjects.

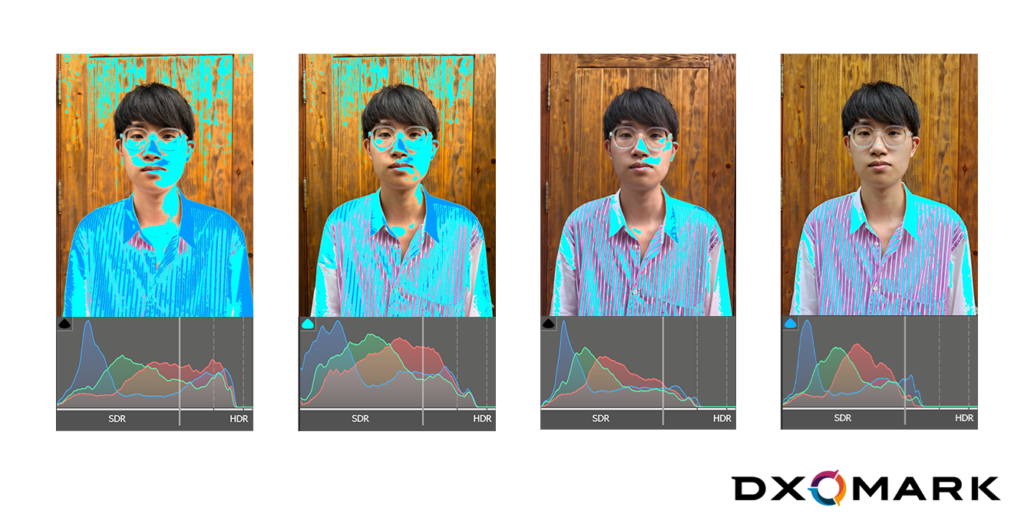

Oppo and Honor primarily boost the highlights, resulting in an overall lower target exposure compared to other flagships (following strategy 1 above). Additionally, Honor and Oppo do not always fully use the headroom, which means they sometimes fail to take full advantage of their HDR displays’ capabilities.

In contrast, Huawei and Apple use part of the headroom to increase the overall brightness of their images (following strategy 2 ). As a result, Huawei and Apple rank higher and are preferred over the Oppo and Honor flagships.

There is a strong correlation between user preference and face/overall image brightness. Huawei and Apple enhance subject brightness by utilizing part of the headroom, a rendering strategy that users find more appealing

The illustrations above show the HDR histogram for each image. The blue pixels in the images highlight the areas rendered within the headroom range of the display. As observed, Huawei and Apple boost certain parts of the face and background to enhance facial brightness and overall image brightness. Oppo and Honor, however, offer minimal boost in these areas, opting instead to partially utilize the headroom only for white parts.

In the example above, we can see that the Huawei and Apple devices use the headroom (highlighted in green) across most of the pixels in the image, while Honor primarily boosts the brightness of the sky in the background. These images, which are for illustration only, have a linear tone map applied to them in order to approximate the appearance of HDR.

The brighter the face the better, but how bright?

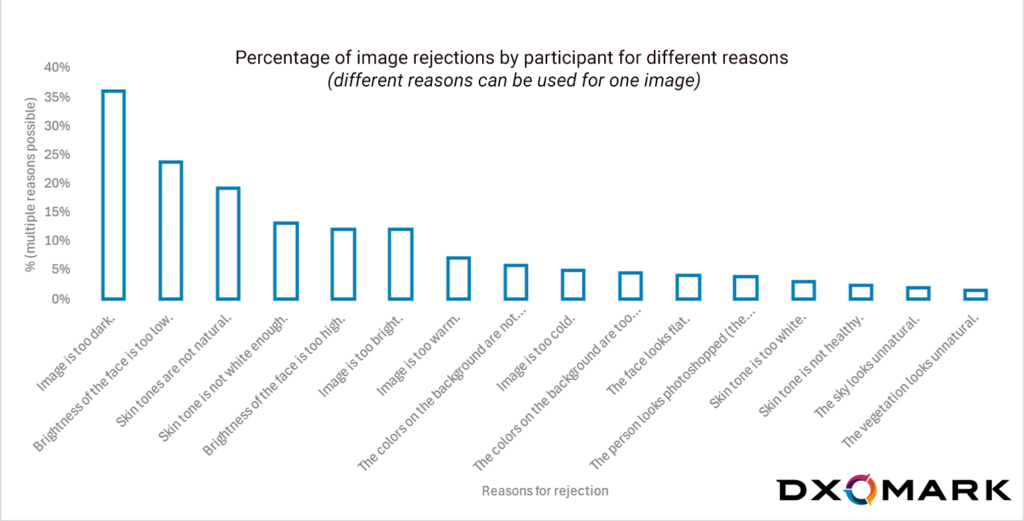

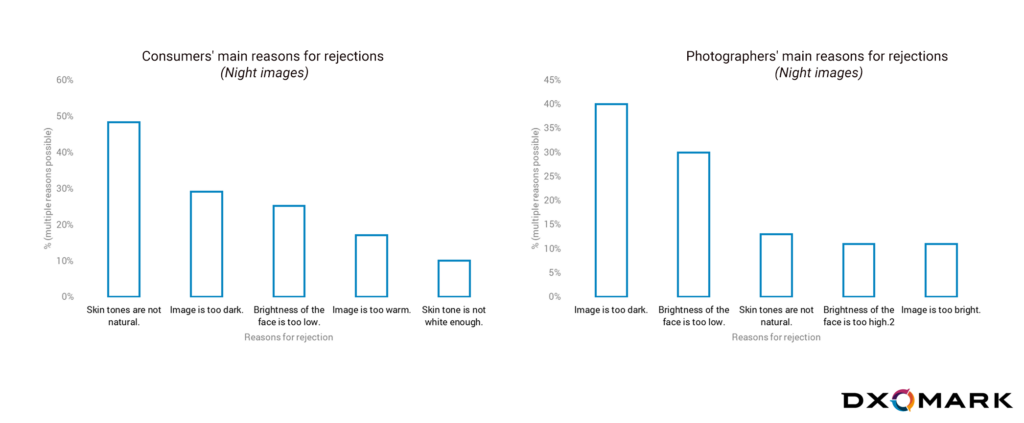

What are the main reasons a picture gets eliminated? We asked our panelists to select the images they wouldn’t post on their social media—an accessible criterion for everyone—and then provide the reasons for their rejection.

The top two reasons participants rejected images were because an image was too dark (36%) or a face was too dark (24%). The third reason was because “the skin tone of the model looks unnatural” (19%). It is interesting to note that Chinese users sometimes identify images as “photoshopped” (5%), when in fact, they are overprocessed by smartphone algorithms or have contrast problems.

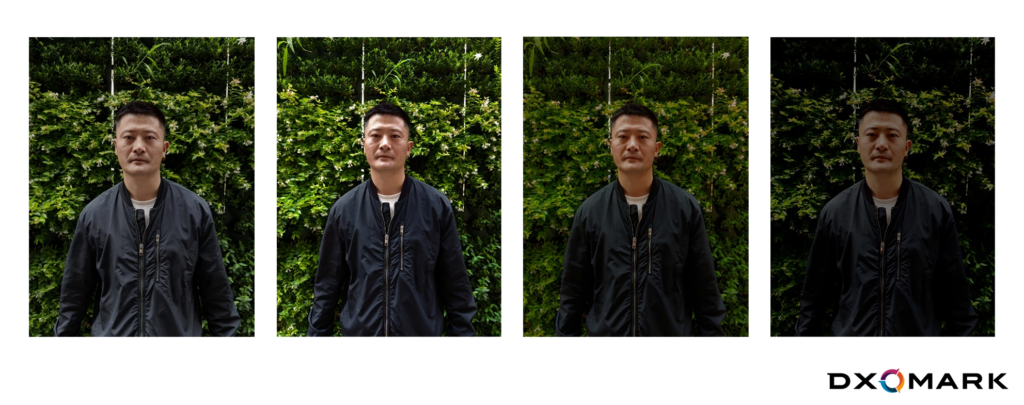

This is the case in the example below. Respondents rejected the renderings of the Apple iPhone 15 Pro Max and Honor Magic6 Pro and thought the photographer’s rendering was the best image.

Participants prefer brighter images, especially when it comes to faces. However, brightness has its limitations. When exposure is high, the skin tone can appear oily or shiny, if there is also clipping on part of the face, or specular reflection, due to overexposure. The appearance of oily areas on the skin can lead to rejection from Chinese users. Although the Vivo device was second in the overall ranking, it was only the third preferred device for outdoor conditions. Users often perceived the face as being “too bright” in these cases, and we consistently observed an oily rendering due to reflections on the skin, which was particularly noticeable on the Vivo device.

Due to the technical constraints in displaying HDR content on the web, please note that the photos in this article are for illustration only. The following images have a linear tone map applied to them in order to approximate the appearance of HDR on devices that have limited dynamic range in terms of brightness. This means that the overall brightness difference between images is more or less preserved compared to their original HDR versions.

“Not white enough”: A local beauty standard persists

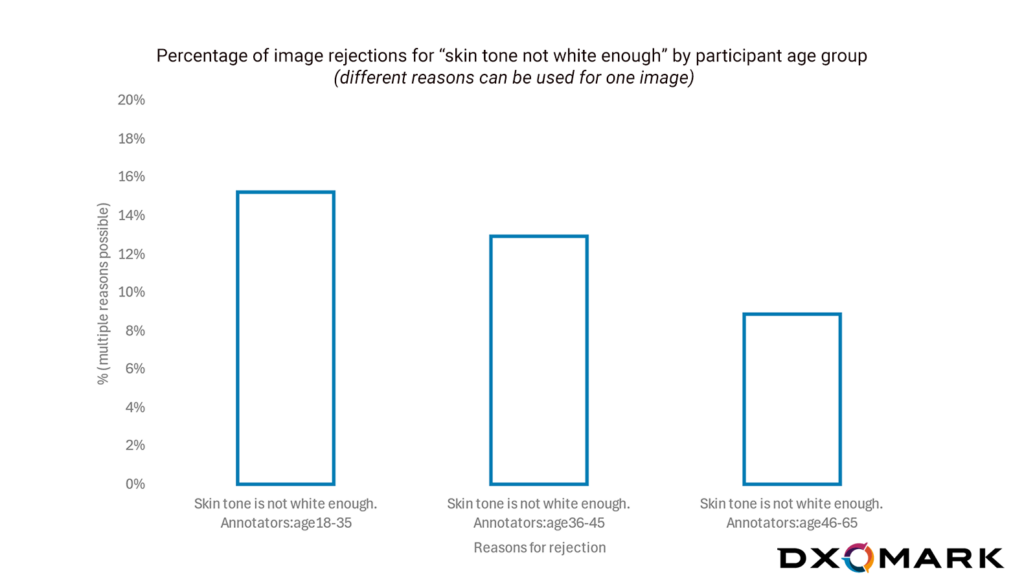

Another reason for rejection is that the skin tone is “not white enough” (13%), confirming that white skin remains a standard of beauty for Chinese consumers. This reason was commonly cited by both men and women, but more so by younger panelists.

This explains the rejection of the iPhone, which provides a warmer rendering of faces.

Pro photographers vs. consumer expectations

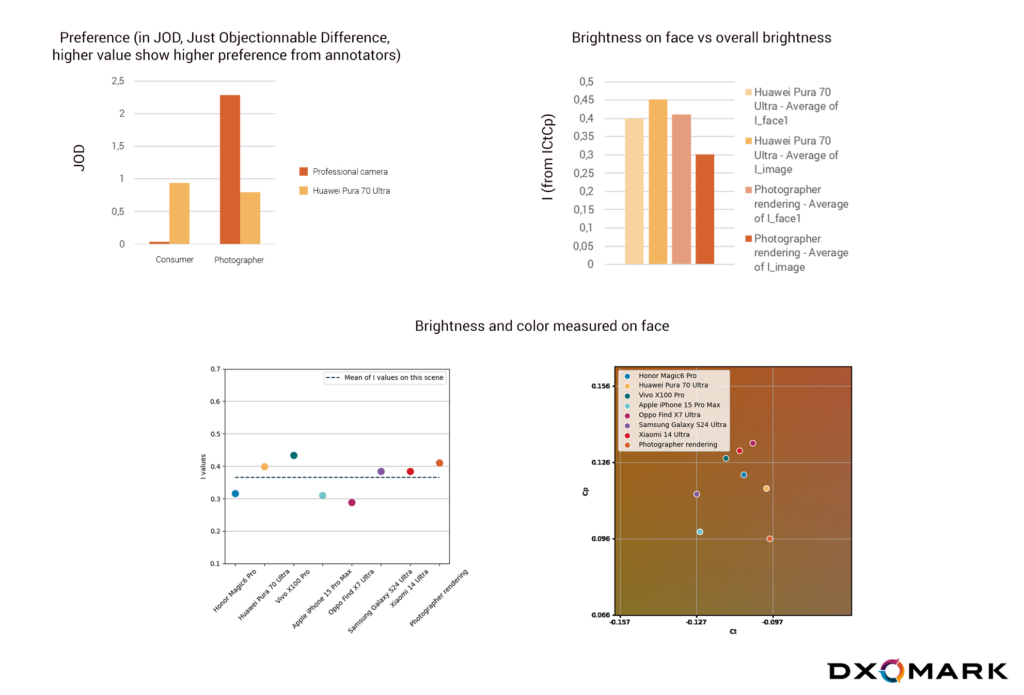

Interestingly, the overall Satisfaction Index for the professional rendering is 89, which is lower than the Huawei and the Vivo devices. In the Paris study, the pictures taken with a professional camera almost always achieved the highest Satisfaction Index. In Shanghai, we observed that consumer expectations can differ from those of professional photographers.

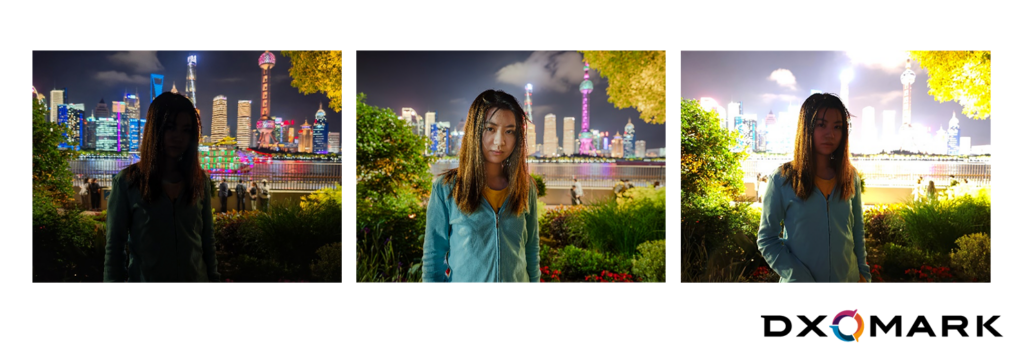

In the example below, the photographer’s rendering highlights its subject with a lot of contrast. The sense of night in the background is better preserved compared to the Huawei Pura 70 Ultra’s rendering, which has a softer overall contrast. In this case, Chinese consumers largely preferred the smartphone rendering, while Chinese professional photographers preferred the professional camera rendering.

When people view their portraits on a smartphone screen, they want their face to be clearly visible and the image to be bright, which might help explain why photographer renderings in this study, which are slightly darker and tend to focus on capturing a mood, get lower ratings.

“Our study shows that face visibility and user satisfaction are strongly correlated when using HDR formats, and that most people preferred images with bright faces, even if it altered the original scene’s atmosphere. Still it is worth noting that the same is not always true for professional photographers, whose preferences are more impacted by subtle colors and contrasts rather than than brightness.”

Pierre-Yves Maître, Image Quality Expert at DXOMARK

Chinese consumer satisfaction is more influenced by face brightness than color, which is not the case for Chinese professional photographers.

The preference ranking between Chinese consumers and Chinese photographers changes slightly for night photography. While Chinese consumers prefer Vivo’s rendering for night pictures, Chinese photographers prefer the Huawei Pura 70 Ultra and the photographer rendering: Photographers show a stronger sensitivity to color and contrast.

The challenges of Chinese use cases for flagships

A portrait with the city skyline illuminated in the background is the most typical use case in our shooting plan. This HDR scene with a backlit model is quite challenging. It appears that this is the use case where flagship devices still face difficulties. In this scenario, the photographer’s rendering demonstrates the best approach, as smartphones struggle to properly illuminate both the subject and the environment.

Another challenge is indoor photography in restaurants or clubs with mixed lighting. Flagship devices still encounter difficulties in these situations. Professional photographers can achieve finer saturation and vibrance tuning with a localized approach, showcasing bright areas while distinguishing the face from the background in terms of brightness.

Going beyond cultural preferences

Huawei and Vivo flagships’ renderings are widely preferred even over the professional photo renderings, and thus in most conditions. With an impressive overall Satisfaction Index, this generation of smartphones provides a generally very satisfying experience for Chinese users.

However, flagship devices still face challenges and shortcomings with key Chinese use cases, such as indoor scenes in clubs and restaurants, and city walks at night. When examining the reasons for picture rejections, besides the universal perception that “the brighter the face, the better,” there are specific aspects of Chinese consumer preferences to consider. This study confirms that results that satisfy a professional photographer might not meet the expectations of a regular consumer using their device.

The new DXOMARK Insights study details the crucial technical factors that ensure high-quality portrait photography and enhance user satisfaction in the HDR ecosystem of every flagship device.

Based on the results observed in the various countries where the study was conducted (France, India, and China), it appears that location is among the influential factors, but not the only one, when it comes to preferences. Instead, there are a host of other factors to consider such as the user’s age, personal ideas about photography, and people’s complexions, just to name a few. In the end, preferences are very personal, and our in-depth and global studies suggest that OEMs should open the way to greater personalization and customization of their devices in all markets.

Learn more about DXOMARK Insights